Litepaper

$PROPHET is a Milady inspired unique project / NFT derivative created on Arbitrum that operates on a simple idea: what if a small team of world class mma gamblers created an ecosystem based off distributing prophets from bets back to token holders and to sweeping collections (will never sell) from the Milady community?

The Thesis

Elite mma betting syndicate known as "The Prophetlady Corporation" generating yield via betting on modern age gladatorial cock fights.

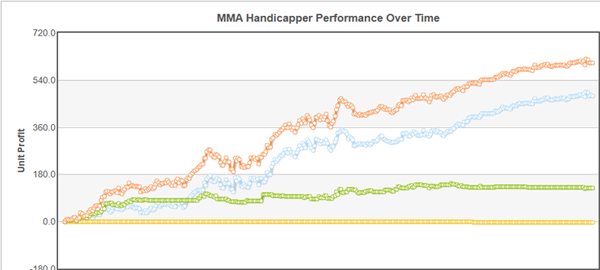

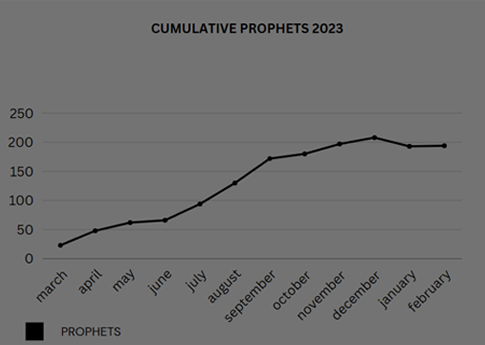

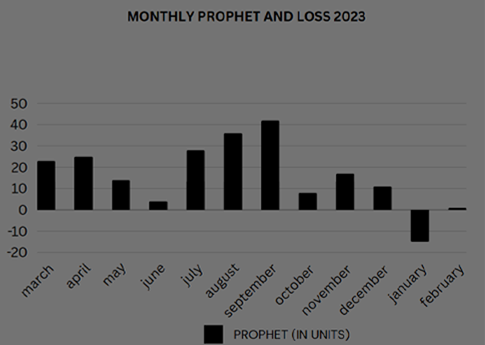

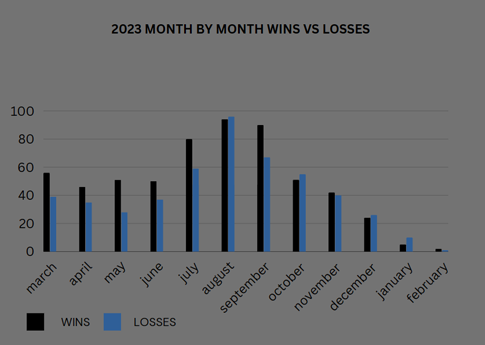

ProphetLady represents the vision of a Milady inspired derivative created by elite gambling autists specializing in MMA betting. Check out the team's tracker here (ranked 5th on the leaderboard)

Since inception of the bet tracker in November 2020, it has generated nearly 700 units in total. Averaging roughly 160% average returns per year over 4 years

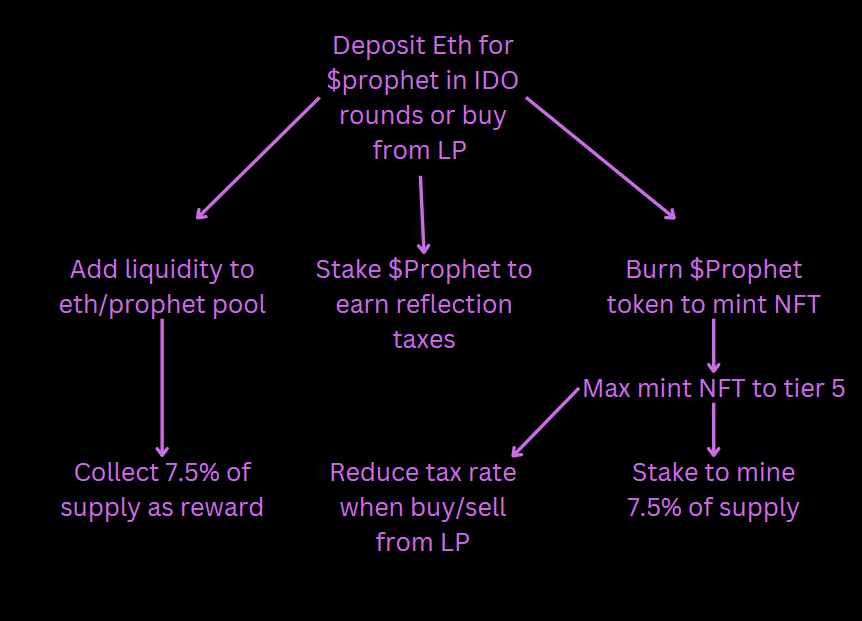

How the ecosystem works

Users who wish to partake can deposit worthless ETH to buy tokens from our IDO Here. As users deposit eth into what is the "treasury", this grows the size of what amounts of $ will be bet. Larger treasury = larger bet sizes = larger prophets (hopefully) = larger NFT Sweeps/larger token buybacks/ token burns. To create a more crypto fun style ecosystem, several additional fun elements have been created, such as:

- Designing this as a tax token, so token stakers are rewarded from total volume traded

- Introducing an NFT that can be bought to reduce tax rates, minted by burning the Prophet token

- The NFT can be 'powered up' to further reduce taxes paid on buys or sells, also done by burning more tokens

- Users can provide liquidity or stake highest 'tier' of NFT to earn prophet tokens, or stake tokens to earn yield paid in ETH

To make clear what you, the noble cryptocurrency participant, can do once buying into the IDO, have 1 of 3 options:

- Provide liquidity, by depositing an eth/prophet pair token into the liquidity pool users will earn a proportional stake of 7.5 million tokens to be emitted daily for 5 years

- Stake the token, in order to earn eth collected from taxes havested from buying and selling the token on the open market

- Mint NFTs, which are created from burning the Prophet token

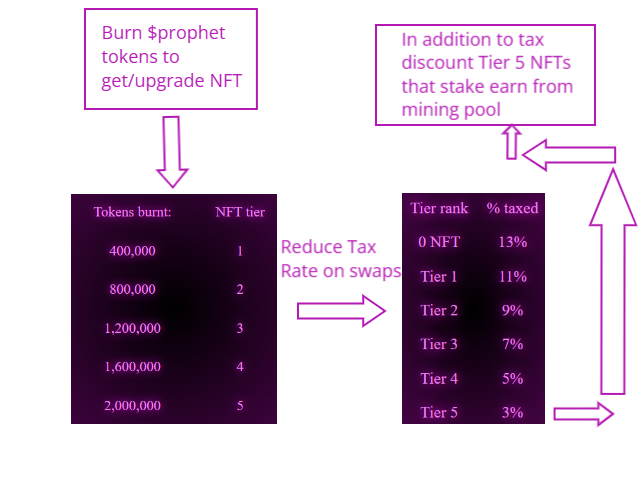

NFT explaination charts...

Burn costs for minting and upgrading each tier of the Prophetlady ecosystem NFT will be fixed at 400k $PROPHET tokens required to reach the next level.

| Tier category | # of tokens to burn | tax rate |

| No NFT | 0 | 13% |

| Tier 1 | 400,000 | 11% |

| Tier 2 | 800,000 | 9% |

| Tier 3 | 1,200,000 | 7% |

| Tier 4 | 1,600,000 | 5% |

| Tier 5 | 2,000,000 | 3% |

Tokenomics

Total tokens in existence = 200,000,000,000

120,000,000,000 (60% of total token supply) $PROPHET will be distributed via 6 stages of IDO, with the price of the token doubling at each 'stage'

| Stage 1 | .000000003125 Eth | 62.5 Eth |

| Stage 2 | .00000000625 Eth | 125 Eth |

| Stage 3 | .0000000125 Eth | 250 Eth |

| Stage 4 | .000000025 Eth | 500 Eth |

| Stage 5 | .00000005 Eth | 1000 Eth |

| Stage 6 | .0000001 Eth | 2000 Eth |

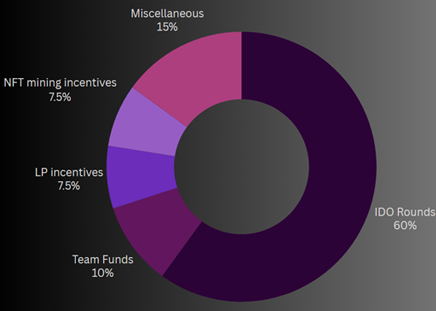

The totality of allocation of the entire token supply goes as follows:

- 60% (120 billion tokens) are in a contract and can only be introduced into circulation upon being bought from one of the IDO rounds

- 10% (20 bilion tokens) are to go to the 3 core team members who are the creators of this idea, the 20 billion tokens are emitted equally on a monthly basis over the course of two years

- 7.5% (15 billion tokens) are dedicated to be emitted to Liquidity providers over the course of 5 years from the start date of this protocol

- 7.5% (15 billion tokens) are dedicated to be emitted to NFT stakers over the course of 5 years from the start date of this protocol

- 15% (30 billion tokens) are dedicated to miscellaneous uses to be determined by the team, users include but are not limited to: burning tokens to mint NFTs to do giveaways to community members, adding additional liquidity, marketing opperations, etc etc...

WATCH OUT!!!

In order to benefit from the NFT tier tax cut, at least one of the leveled up NFT's must be unstaked! Don't CUCK yourself and swap without an unstaked level 5 NFT in your wallet.

Musings...

The name of the game here is large numbers/ scaling. Assume that the team can deliver 100% roi a year and has 3 of the IDO stages fully funded. As of this writing that would equate to roughly $750,000. At 2% a week returns, half of the proceeds would be dedicated to sweeping NFTS ($7500 a week) while also being able to buyback and burn approximately 333 million tokens a week. If this were to hold consistant throughout a year that would mean... approximately 17 billion tokens a year get removed from total possible market supply.

Now consider the firepower this protocol has at a max raise (approximately $7,000,000). At this level, assuming 2% weekly returns means close to 400 million tokens get bought/burnt a week and $70,000 a week in NFT sweeps.

It is the stated goal of this project to sweep roughly 2-10% of 15-20 Nft projects that are in the Remilia universe or are widely considered to be a derivate. To further go on, if after a couple years the Prophetlady Corporation has swept say 5-10% of the total collections we are interested in, then the entire amount of prophets would go to buybacks/burns (roughly 800 million tokens a week/ 40 billion a year).

Lastly, consider if all NFTs in the prophetlady collections were to be minted and upgraded (50,000 total x 2 million to max upgrade) this would take out half of the total token supple. If one were to add these two possibliities together that means that hypthetically the entire 200 billion token supply could be completely burned within 5 years of completeing multiple IDO rounds.

DISCLAIMER

Statistics being indicative:

All Stats listed on this site are for guidance purposes only. Listed statistics are not guarenteed to be accurate. Apy generated for users changes constantly and is purely determined by volume created by other users not Prophetlady. Users acknowledge this and also acknowledge the risk of negative returns on deposited funds into IDO vaults at any and all time periods. By depositing into IDO vaults, the user assumes risk of losses.

Prior returns:

Any and all prior prophet from betting is to not be viewed as indicative of any future returns or prophet.

Risk of loss of funds when interacting with Prophetlady:

Prophetlady ecosystem is a smart contracts based suite of technologies that relies on blockchain technology. By depositing funds into Prophetlady IDO and staking vaults the user will recognize and assume all risks inherent in such technologies, including but not limited to the risk that the smart contracts underlying previously mentioned vaults could fail, resulting in a total loss of user funds. Prophetlady is not responsible for any such losses.

UI usage and legal jurisdictions:

Our Interface is NOT offered to persons or entities who reside in, are citizens of, are incorporated in, or have a registered office in the United States of America or any Prohibited Localities. Prophetlady is a decentralized meme experimental project and does not hold any securities licenses in the U.S. or any other jurisdiction. Any investment made through our protocol shall be made with this in mind. Furthermore, by accepting these terms you acknowledge and warrant that you are not a citizen of or otherwise accessing the website from the following nations or geographical locations: Democratic Republic of Congo, Cote D'Ivoire (Ivory Coast), China, Cuba, Hong Kong, India, Iraq, Iran, Democratic People's Republic of Korea (North Korea), Libya, Mali, Myanmar (Burma), Nicaragua, Sudan, Somalia, Syria, Yemen, Zimbabwe, and/or any other jurisdiction prohibited by the United States Office of Foreign Asset Control (OFAC).